The Merits of Refinancing Business Assets in the UK: A Comprehensive Look

In the dynamic world of business finance, business owners often seek avenues that can enhance their company’s financial health.

One such effective strategy, particularly popular in the UK, is the refinancing of business assets.

But is it the right move for every business?

Let’s delve deep into this topic and explore the reasons that make refinancing an enticing option for many.

What Does Refinancing Business Assets Entail?

Refinancing, in essence, means securing finance against assets that the business already owns with the aid of a new asset finance agreement.

This new agreement is used to pay off the previous debt, if any finance is on the assets, and to raise additional cash for the business.

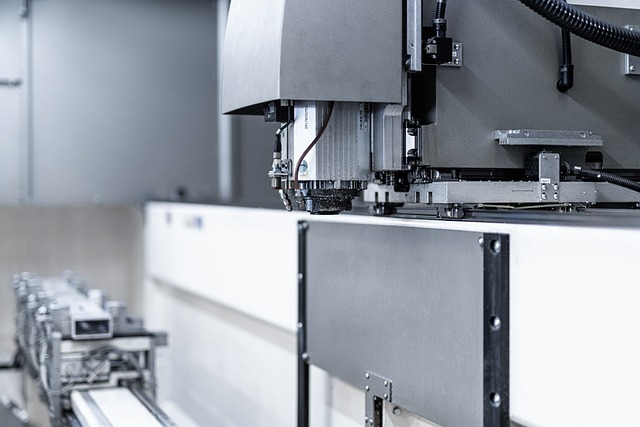

Businesses often resort to this method for assets like machinery, property, or even company vehicles.

Why Consider Refinancing Your Business Assets?

1. Unleashing Locked Capital

By opting to refinance, you can effectively tap into the equity built up in your assets.

This provides immediate access to liquidity, which can be seamlessly channelled into growth-driven ventures, funding business expansion, or catering to immediate financial requirements.

2. Sculpting a Healthier Cash Flow

Cash flow challenges can impede the growth of even the most promising businesses.

Refinancing can introduce you to advantageous repayment scenarios.

This could mean elongated repayment windows or even reduced interest rates.

The potential result? A notable reduction in monthly outgoings and a healthier cash flow.

3. Streamlining Debt Management

With debts scattered across multiple avenues, managing them can become an arduous task.

Refinancing allows businesses to amalgamate these scattered debts into one consolidated loan.

The outcome is a simplified financial landscape and reduced administrative efforts.

4. Securing Optimal Loan Conditions

The financial market is in perpetual flux.

Over time, you might find that the terms you initially agreed upon are no longer competitive.

Refinancing opens doors to renegotiating the specifics of your loan agreement.

Whether it’s a reduction in interest rates, minimised associated fees, or more accommodating repayment terms, refinancing can be your ticket to a better deal.

5. Bolstering Credit Profiles

A less-talked-about yet significant advantage is the potential upliftment of your credit rating.

Consistent adherence to your new repayment schedule post-refinancing reflects positively on your credit profile, making future borrowings more accessible and potentially more affordable.

The Crucial Consideration

While the reasons to consider refinancing are plenty, it’s paramount to remember that it’s not a one-size-fits-all solution.

Every business is unique, and the decision to refinance should hinge on its current fiscal health, long-term objectives, and the nuances of the refinancing deal on offer.

It’s often recommended to liaise with seasoned financial advisors or trusted commercial brokers like The Funding Store to ensure you’re making an informed decision.

To Refinance or Not: The Conclusion

The realm of business financing offers a myriad of tools, each with its own set of advantages.

Refinancing stands out as a powerful instrument that can redefine a company’s financial trajectory.

While it presents numerous benefits, it’s essential to tread with caution, making sure it aligns with your business’s broader goals.

If you’re a small or medium-sized business looking for funding, then why not contact The Funding Store today.

We do not charge broker fees, and with access to one of the most extensive and competitive lending panels in the UK, can bring you fast, flexible solutions that meet your finance needs.

The Funding Store can help guide you through the funding process and find the best funding options that fit your specific needs.

Whether you’re looking to start a new business, expand an existing one, or cover unexpected expenses, The Funding Store can help you achieve your financial goals.

So don’t hesitate, contact us today on 01908 880420, to take the first step towards securing the funding you need to grow and succeed.

Share This Story, Choose Your Platform!

This article has been produced by www.TheFundingStore.co.uk for general interest. No responsibility for loss occasioned to any person acting or refraining from action as a result of the information contained in this article is accepted by The Funding Store Ltd. In all cases appropriate professional legal and financial advice should be sought before making a decision.