Invoice Finance

Release Cash Tied Up In Your Existing Invoices

Maximizing Your Cash Flow, Simplifying Your Success

Advance up to 95% of the value of your invoices; Access your cash within 24 hours of setting up your facility; A working capital facility that grows alongside your business; Avoids taking on additional debt; Funding that grows with your business; Have leading lenders compete for your business; Release cash from your invoices; Get multiple quotes without endless phone calls;Advance up to 95% of the value of your invoices; Access your cash within 24 hours of setting up your facility; A working capital facility that grows alongside your business; Avoids taking on additional debt; Funding that grows with your business; Have leading lenders compete for your business; Release cash from your invoices; Get multiple quotes without endless phone calls;

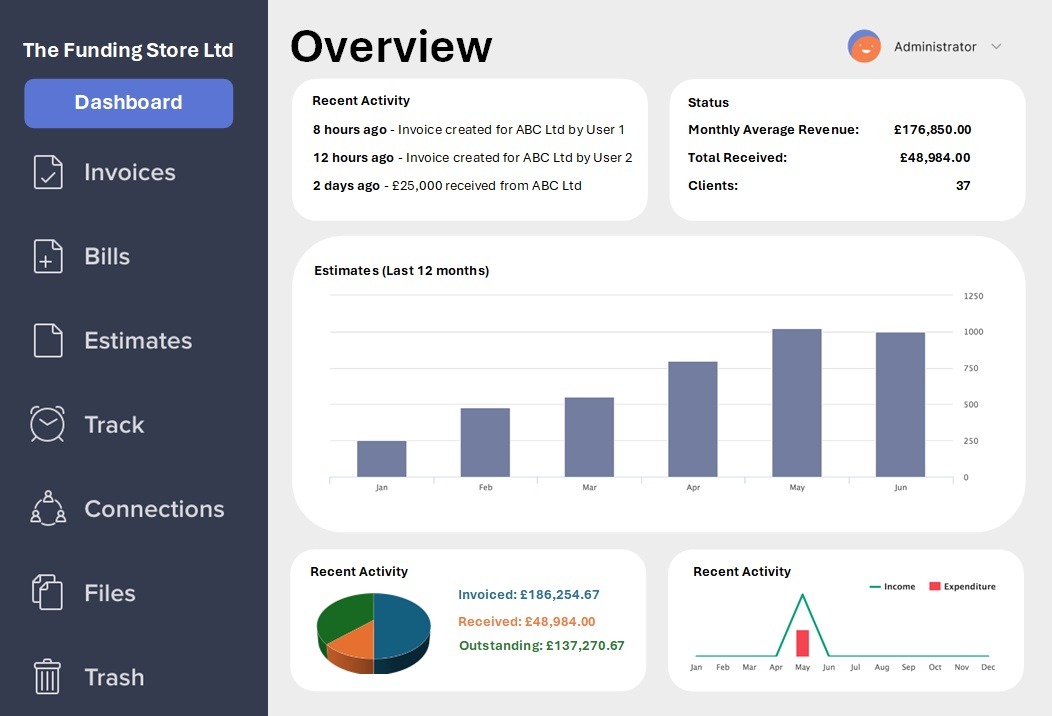

How it works

Invoice finance for startups

In the dynamic landscape of UK business, The Funding Store stands as a beacon for both established and emerging enterprises seeking financial agility. As a premier UK Commercial Finance Broker, we specialise in tailoring solutions that resonate with the unique needs of new start-ups and established entities alike.

Our focus today turns to New Start Invoice Finance – a transformative tool designed to propel your business into its next growth phase.

At the heart of our service lies a commitment to enable scalability and expansion. New Start Invoice Finance is not just about alleviating cash flow challenges; it’s a strategic move to empower your business.

By unlocking the potential tied up in unpaid invoices, this financial instrument offers a lifeline for startups eager to scale up without the traditional constraints of conventional funding methods.

Distinctively, The Funding Store prides itself on sourcing from an extensive panel of the UK’s leading Invoice Finance (IF) providers. Our offerings are diverse, catering to the needs of new startups and extending up to sophisticated solutions for large corporate facilities.

This flexibility ensures that no matter the size or stage of your business, our expertly curated invoice finance solutions are designed to align with your unique business trajectory.

What is New Start Invoice Finance?

New start invoice finance is a transformative financial solution designed to support the aspirations of emerging and established UK businesses.

At its core, this approach allows companies to harness the untapped value in their accounts receivable. By converting outstanding invoices into immediate working capital, businesses can overcome the common cash flow challenges that often hinder growth and operational efficiency.

This method of finance is particularly advantageous for startups and new businesses, which may face difficulties in securing traditional bank loans due to limited credit history or lack of security.

New start invoice finance, offered through The Funding Store’s extensive network of the UK’s leading invoice finance (IF) providers, is tailored to accommodate these unique needs.

It offers a flexible, less stringent, and more accessible financing option, enabling businesses to maintain a healthy cash flow without the wait or the burden of conventional loan structures.

Below, we’ll explore how new start invoice finance operates, its suitability for various business models, and how it aligns perfectly with the aspirations of modern UK enterprises striving for growth and sustainability.

Types of Invoice Finance Available for Startups

Invoice finance for startups comes in various forms, each tailored to different business needs and growth stages. Understanding these options is key to choosing the right solution for your business.

- Invoice Factoring: This is ideal for startups needing full-fledged sales ledger management. Factoring companies purchase your unpaid invoices, providing immediate cash. They also manage collections, saving you time and administrative hassle.

- Invoice Discounting: Suited for businesses with established finance departments, this option offers immediate cash flow while you retain control over your sales ledger and collections process.

- Selective Invoice Finance: A flexible choice, allowing startups to finance selected invoices. It’s perfect for businesses that need a quick cash flow boost without committing to long-term contracts or financing their entire sales ledger.

Each type has its unique benefits. Factoring provides comprehensive support, discounting offers control and confidentiality, and selective finance delivers flexibility. The Funding Store, leveraging its vast network of top UK IF providers, helps startups navigate these options, ensuring a solution that aligns with their growth trajectory and operational needs.

Benefits of New Start Invoice Finance

- Prompt Cash Flow Enhancement: Startups can swiftly access funds, directly proportional to their outstanding invoices’ value, mitigating the usual delays in customer payments.

- Expert Invoice Management: Opting for factoring often includes professional invoice collection services, allowing startups to dedicate more resources to core business activities.

- Robust Credit Management: Collaborating with a factoring firm typically involves advanced credit assessments and checks, substantially minimising the risk of non-payment and bad debts.

- Customizable Financial Solutions: The flexibility of invoice factoring lies in its adaptability to various requirements, be it a singular cash influx or a consistent financial support system fostering ongoing business growth.

Advantages of New Start Invoice Finance

New start invoice finance offers a range of benefits specifically tailored to meet the evolving needs of startups in the UK. These advantages include:

- Immediate Financial Boost: Startups can access funds quickly, which is crucial for maintaining continuous operations and capitalising on growth opportunities.

- Enhanced Liquidity: This financing option provides a more predictable cash flow, helping startups manage their day-to-day expenses more efficiently.

- Reduced Credit Risk: With professional credit checks and risk assessments conducted by invoice finance providers, startups are better protected against bad debts.

- Flexibility in Growth Support: Whether it’s for a one-off project or ongoing business expansion, new start invoice finance offers customisable solutions to suit various financial requirements.

- Streamlined Administration: By outsourcing invoice management and collections, startups can focus more on their core business activities, fostering productivity and innovation.

These benefits collectively make new start invoice finance a compelling option for startups looking to navigate the financial challenges of their early stages while paving the way for sustainable growth.

How to Choose the Right Invoice Finance Option

Selecting the ideal invoice finance option for a startup involves a careful evaluation of the business’s specific needs and goals. Things to consider before making an informed decision:

- Assess Your Cash Flow Needs: Determine the urgency and volume of your cash flow requirements. This helps in deciding whether a comprehensive solution like factoring or a more controlled option like discounting is suitable.

- Consider Your Credit Management Capacity: If your startup is equipped to manage credit control, invoice discounting may be preferable. Otherwise, factoring, which includes credit management services, might be more beneficial.

- Evaluate Your Customer Base: Understanding the payment habits of your customers can guide you in choosing between whole ledger financing or selective invoice finance.

- Flexibility and Terms: Consider the flexibility of the financing terms. Startups often benefit from adaptable solutions that can scale with their growth.

- Compare Costs and Benefits: Analyse the fees and charges associated with different options, weighing them against the benefits they offer.

- Expert Advice: Working with a knowledgeable finance brokerage like The Funding Store can provide valuable insights, ensuring you choose an option that aligns with your business’s unique needs.

Making the right choice in invoice finance can significantly impact a startup’s growth trajectory and operational efficiency.

New start invoice finance stands as a pivotal resource for UK startups and growing businesses, offering a lifeline in the fast-paced commercial world.

It’s not merely a financial tool; it’s a strategic asset empowering companies with immediate cash flow, enhanced credit control, and the flexibility to seize growth opportunities.

The Funding Store, with its expertise and a comprehensive panel of leading UK IF providers, is committed to guiding startups through this journey.

Embracing new start invoice finance can be the catalyst that transforms potential into progress, positioning your business for a future of success and expansion.

Helping you find the right finance for your business

At The Funding Store we know our finance, and we know how important it is for small businesses to access the right finance, at the right time.

Put our team to the test. Contact us today and let’s talk about your specific needs. We will then set about finding the right finance for your business, all without obligation of course.

Why use The Funding Store?

We Build Relationships

We are continually reviewing funding providers to bring you choice, competitive rates and flexibility allowing you to access the right finance, at the right time.

Dedicated Account Managers

Most importantly, we are passionate about what we do. This is evident in our enthusiasm and commitment to assisting you at each stage and after you have secured your finance.

Invoice finance made simple

Whether you need to buy new equipment, take on new staff or finance an office or retail fit-out, we can help you at every step.

Based in Milton Keynes, our team are fast moving and the application process is simple and fast. We will talk you through the process to find finance that meets your needs.

We can offer you a same day decision and in some cases, depending on the loan provider selected, can have your finance in your account the same day as your application.